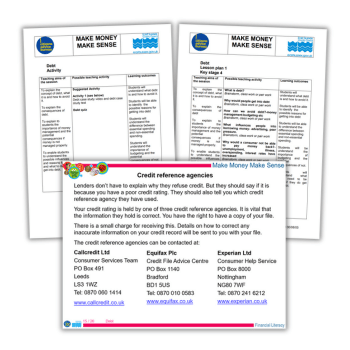

This download contains a debt lesson plan for KS3 and two debt lesson plans for KS4, including PowerPoints to show in class.

Teaching students about debt is essential for building financial literacy, preventing bad habits, and promoting long-term stability.

These debt lesson plans can help students make informed decisions, avoid debt traps, and will reduce anxiety about money as they transition into adulthood.

Debt lesson plan learning outcomes

- Understand what debt is and how to avoid it

- Identify the possible reasons for getting into debt

- Understand the difference between essential spending and non-essential spending

- Understand the importance of budgeting and the potential consequences of not

- Understand what steps you need to take if you get into debt

Activities include reading a debt case study about a 22-year-old man in debt and considering the following questions:

- What caused this person to get into debt problems?

- Was there one single factor or a combination?

- What factors could have influenced this person’s spending when at university?

- What effect did the car crash have?

- What could he have done differently?

Citizenship curriculum

KS3

In KS4 Citizenship classes, you need to teach pupils about the functions and uses of money, the importance and practice of budgeting, and managing risk.

KS4

In KS4 Citizenship classes, pupils should be taught about income and expenditure, credit and debt, insurance, savings and pensions, financial products and services, and how public money is raised and spent.

Make Money Make Sense was developed by Eastbourne Citizens Advice Bureau and East Sussex Trading Standards and produced resources for teaching the financial literacy aspects of the citizenship curriculum.